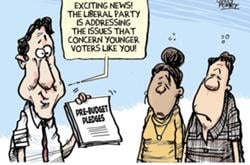

The Canadian government has unveiled its 2024 federal budget, with a particular emphasis on restoring what it calls “generational fairness” for millennials and gen Z.

The government says it’s committed to addressing the unique challenges faced by younger generations, including housing affordability, job prospects and the high cost of living. Its focus on generational fairness ostensibly aims to level the playing field in the rental and housing markets, among other places.

“We are moving with purpose to help build more homes, faster,” Finance Minister Chrystia Freeland said after tabling the budget. “We are making life cost less. Millennial and gen-Z Canadians — we want them to look forward to the future with a sense of anticipation, not angst.”

But whether the budget delivers on these aims is in the eye of the beholder.

Housing in the budget spotlight

Certainly, housing affordability, both for renters and for homeowners, is a top focus of the budget. Housing takes up $8.5 billion of the projected $53 billion in new spending.

The withdrawal limit for the Home Buyers’ Plan, which allows taxpayers to borrow from their retirement savings plan tax-free to purchase a home, has been increased from $35,000 to $60,000. And for some taxpayers, the repayment period for the Home Buyers’ Plan has been extended.

While these are welcome benefits for first-time homebuyers, some economists argue the root of the housing affordability crisis lies not on the demand side, but rather in a lack of supply.

On the supply side, incentives for the construction of purpose-built rental housing have been established, including enhanced writeoff rates for certain rental properties, interest deductibility opportunities and GST rental rebates.

These initiatives are all designed to further incentivize the development of rental housing, which millennial and gen-Z Canadians commonly reside in. The federal government’s housing plan aims to generate an additional 3.87 million new homes by 2031. That said, nearly half of these would likely be built anyway, without the government’s actions.

The federal government is also exploring building homes on Canada Post properties and national defence lands across the country.

Renters are clearly a focus area of recent Canadian government initiatives, including efforts to set up a $15-million tenant protection fund to mitigate the adverse effects of rising rent and renovictions, a Canadian Renters’ Bill of Rights and an initiative to have renters’ payment history count toward their credit score.

The credit score initiative is important because it may help renters transition to home ownership by qualifying for a mortgage.

Other measures aimed at younger Canadians

Climate anxiety is increasingly common among millennial and gen-Z Canadians. The federal budget lays out several clean economy incentives, including investment tax credits for activities involving clean hydrogen, clean electricity and clean technology. Further investment tax credits support the production of electric vehicles and their components.

Students also get a break. Investments in student grants and interest-free loans are on the horizon, with a projected cost of $7.3 billion this coming academic year.

While it’s clear that numerous initiatives have been created to home in on pressing issues for younger Canadians, whether or not these programs will have their intended effect remains to be seen.

Some are concerned the federal spending outlined in the budget will fan the flames of inflation, which in June 2022 reached a peak of 8.1 per cent. Data from an Angus Reid survey this year found that younger Canadians are most impacted by inflation.

The 2024-25 deficit is projected to be $39.8 billion, with no plans to arrive at a balanced budget in the next five years.

Capital gains changes

One way the federal government will raise revenue to support the new budget initiatives is by increasing the capital gains inclusion rate. Starting on June 25 of this year, 66 per cent of capital gains earned by corporations and trusts will be subject to income tax, up from 50 per cent.

For individuals, capital gains of over $250,000 in a year will be hit by the higher inclusion rate. The federal government estimates this change in policy will affect only 0.13 per cent of Canadians with an average income of $1.4 million, and will raise $19.4 billion over five years.

On the flip side, Canadian entrepreneurs will potentially gain access to lower capital gains tax by way of the Canadian Entrepreneurs’ Incentive, which reduces inclusion rates to 33 per cent.

If you are one of 28.5 million Canadians who are unlikely to earn capital gains next year, you will probably not see a higher tax bill resulting from these changes.

It appears that efforts are being taken to live up to the “generational fairness” tenet held up as a guiding light for the federal budget. Whether the initiatives will deliver on this aspiration, however, is subject to speculation.![]()

![]()

Read more: Federal Politics

Tyee Commenting Guidelines

Comments that violate guidelines risk being deleted, and violations may result in a temporary or permanent user ban. Maintain the spirit of good conversation to stay in the discussion and be patient with moderators. Comments are reviewed regularly but not in real time.

Do:

Do not: